Dubai Residential Market Q4 2025: Data-Driven Analysis of Prices, Transactions, Supply, and Buyer Behavior

1. Introduction

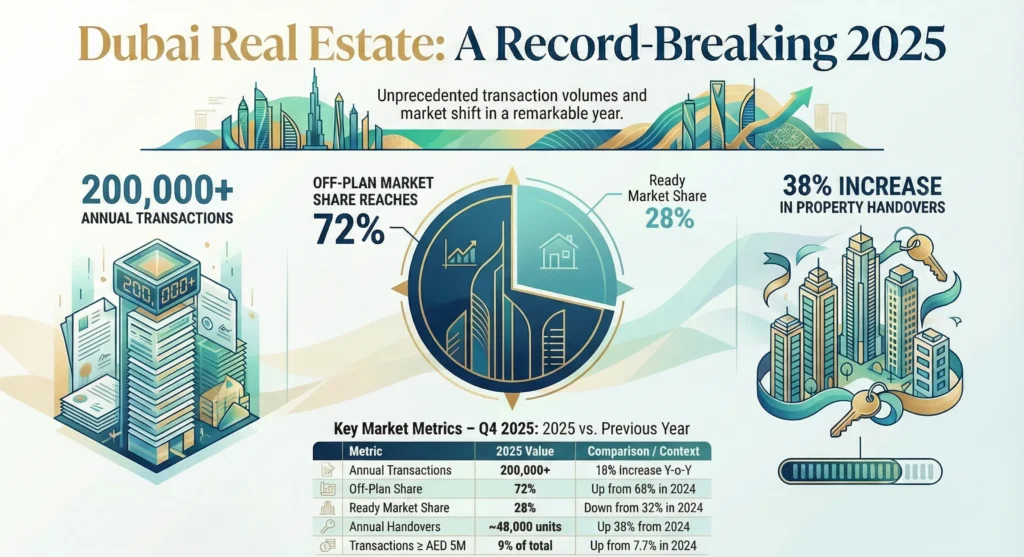

The Dubai Residential Market Q4 2025 marks a defining period in the emirate’s housing cycle, closing a year that delivered unprecedented transaction volumes, sustained price appreciation, and a rapidly expanding development pipeline. According to the Q4 2025 market report, Dubai’s residential sector recorded its third consecutive quarter with over 50,000 transactions, pushing annual volumes beyond 200,000 transactions, an 18% year-on-year increase.

Q4 2025 is significant not only because it capped a record-breaking year, but because it highlighted several structural shifts within the Dubai property market 2025—most notably the dominance of off-plan sales, changing buyer affordability dynamics, and early signs of future supply pressure. This quarter provides critical insight into how demand, pricing, and supply are interacting across Dubai residential real estate as the market moves beyond a period of undersupply.

2. Dubai Residential Market Q4 2025 at a Glance

Dubai’s residential market maintained strong momentum throughout Q4 2025, supported by population growth, investor confidence, and sustained interest from high-net-worth individuals.

Key takeaways include:

- Annual residential transactions exceeded 200,000, the highest level on record.

- Off-plan sales accounted for 72% of all transactions, continuing a multi-year upward trend.

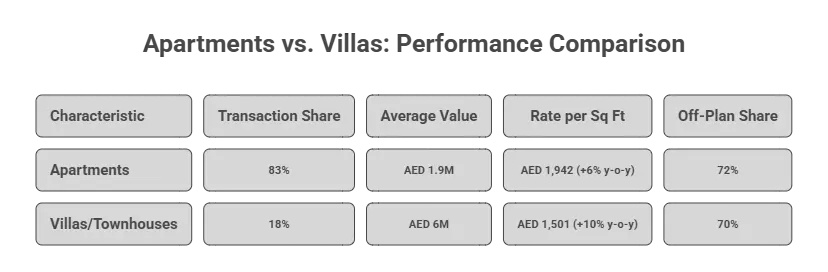

- Apartment transactions dominated, representing 83% of total sales.

- Capital values rose across most submarkets, with average apartment prices remaining stable while villa and townhouse prices increased.

- Supply delivery increased year-on-year, though handovers slowed in Q4 compared to earlier quarters.

- Prime residential demand strengthened, with transactions above AED 10 million increasing 43% year-on-year.

3. Overall Residential Market Performance in Dubai

Transaction activity across Dubai residential real estate in 2025 reached unprecedented levels, with annual volumes exceeding 200,000 deals and Q4 continuing the trend of quarterly volumes above 50,000. This sustained pace over multiple quarters signals that demand is broad-based rather than driven by a single short-lived spike.

Off-plan transactions were the defining feature of the Dubai property market in 2025, rising to 72% of all residential deals versus 68% in 2024 and 60% in 2023. In contrast, the ready market kept its absolute volume broadly stable but now accounts for only 28% of transactions, down from 32% and 40% in the previous two years, underscoring how new launches are capturing a larger share of activity.

From a pricing perspective, capital values in ready stock continued to appreciate, supported by refurbishment activity in mature communities and persistent demand at higher ticket sizes. The proportion of deals above AED 5 million rose to 9% of all transactions, illustrating both price growth and deep liquidity at the upper end of the Dubai housing market Q4 2025.

On the supply side, 2025 registered approximately 48,000 handovers, a 38% increase versus the roughly 35,000 units completed in 2024 and similar to 2023 levels. Handovers slowed significantly in Q4, to around half of the volumes seen in Q1–Q3, even as transaction activity remained strong, which helped support pricing and absorption.

4. Apartment Market Performance in Dubai Q4 2025

Apartments dominated the Dubai Residential Market Q4 2025, accounting for 83% of all residential transactions during 2025, up from 81.3% in 2024. This growing share indicates that apartments remain the primary entry point for both investors and end-users in Dubai residential real estate.

Off-plan apartments led demand, representing 72% of all apartment transactions in 2025, rising from 68% in 2024 and 58% in 2023. This progression highlights a clear shift toward buying properties under construction, driven by payment plans and perceived upside, while the ready apartment segment continues to transact but at a relatively smaller proportion.

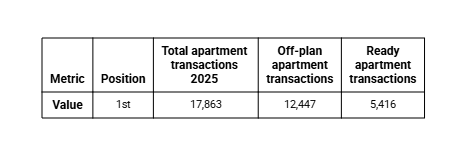

From a pricing standpoint, the average capital value for apartments hovered around AED 1.9 million in 2025. Average apartment rates reachedAED 1,942 per square foot in 2025, reflecting a 6% year-on-year increase and indicating broad-based value appreciation across this segment. In terms of locations, Jumeirah Village Circle (JVC), Business Bay, and Dubailand were the top three apartment markets by transaction volume for the full year 2025. Other active areas in Q4 included Jumeirah Village Triangle and Majan, which combined established and emerging districts underlining the depth of demand along key corridors.

5. Villa & Townhouse Market Performance

Villas and townhouses maintained an 18% share of total residential transactions in 2025, roughly in line with 2024, signalling steady interest in horizontal communities within the Dubai property market 2025. However, volumes in this segment softened in the second half of the year, normalising after an elevated H1.

Average ticket prices for villas and townhouses exceeded AED 6 million in 2025, up from AED 5.4 million in 2024. This increase was progressive, with average values reaching AED 5.9 million by the end of H1 and rising further to AED 6.3 million by the end of H2, demonstrating continued up-trending capital values for this segment.

On a per-square-foot basis, villas achieved average rates of AED 1,501 in 2025, marking a 10% year-on-year increase and outpacing apartment rate growth. This stronger rate expansion suggests tighter supply and higher relative demand for villas and townhouses compared with apartments in many submarkets.

In terms of volumes, villa and townhouse transactions declined from around 10,500 per quarter in H1 to approximately 7,300 per quarter in H2, bringing quarterly activity back toward 2023–2024 levels. Under-construction products remained especially popular, with 70% of villa transactions in 2025 occurring in under-construction projects, up from 68% in 2024 and 64% in 2023.

6. Area-wise Residential Market Analysis

Dubai is segmented into multiple zones, with particularly strong activity concentrated in Zone 6, spanning the Al Khail corridor and Dubailand. This area has emerged as a focal point for both transactions and new supply, driven by high activity across communities such as Jumeirah Village Circle (JVC), DAMAC Hills 2, Al Barari, and Dubai Hills Estate, which together represent the heart of recent residential market momentum.

Overall, 52% of all residential transactions in 2025—equating to more than 110,000 deals—were concentrated in Zone 6. This is the third consecutive year that Zone 6 has held around a 50% share of annual transaction volumes, indicating a structural dominance by this corridor in the Dubai residential market.

a) Jumeirah Village Circle (JVC)

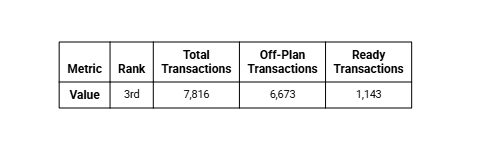

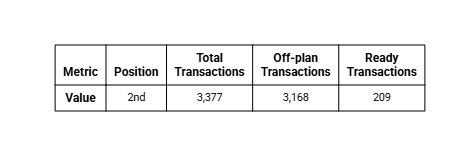

JVC was the leading apartment location by transaction volume in 2025, underlining its position as a key mid-market hub within the Dubai housing market Q4 2025. Both off-plan and ready stock in JVC continued to transact at scale, benefiting from ongoing launches and established community infrastructure.

b) Business Bay

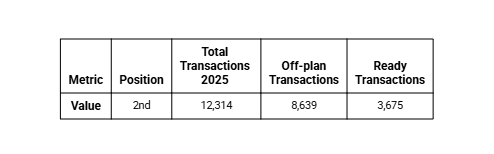

Business Bay ranked second in apartment transaction volumes for 2025, reflecting strong demand for centrally located, mixed-use urban living. The area continued to attract both investors and occupiers, supported by ongoing off-plan launches and high liquidity in the secondary market.

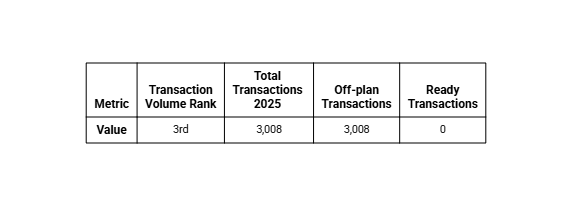

c) Dubailand

Dubailand placed third in the 2025 apartment rankings by transaction volume, indicating its importance as a growth corridor within the Dubai residential market Q4 2025. The area benefits from a mix of established communities and emerging projects, with strong representation in both off-plan and ready product.

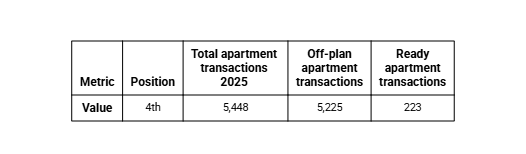

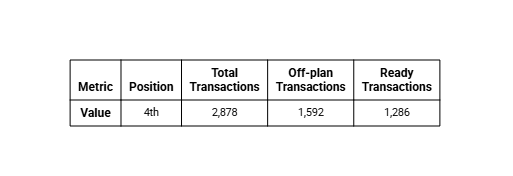

d) Dubai Science Park

Dubai Science Park featured among the top five apartment locations by transaction volume, reflecting demand in more niche, emerging submarkets. Activity has been led more by off-plan launches, with ready stock playing a smaller role compared to the leading zones.

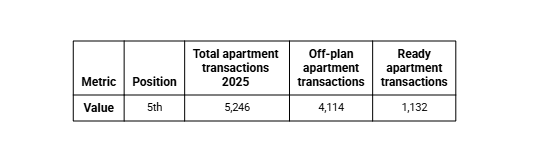

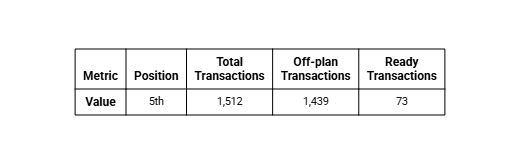

e) Dubai Production City

Dubai Production City rounded out the top five apartment locations, highlighting the breadth of transaction activity outside traditional prime districts. The bulk of transactions here are also skewed toward off-plan projects, consistent with the citywide off-plan dominance.

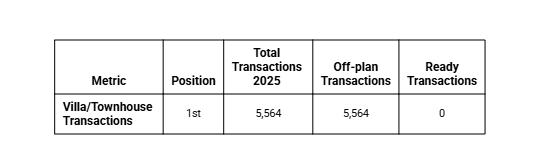

f) Damac Island City

On the villa and townhouse side, Damac Island City was the top location by transaction volume in 2025. All villa/townhouse transactions here were off-plan, reflecting its status as a large-scale master development at an early delivery stage.

g) The Valley

The Valley was another major villa/townhouse hub, with a mix of off-plan and ready transactions. It also recorded high Q4 transaction volumes, supported by ongoing handovers and active buyer interest.

h) Dubai Investment Park 2 (DIP 2)

DIP 2 maintained a strong presence in Q4 villa/townhouse transactions and ranked among the top five locations for the year. Its activity is largely underpinned by under-construction projects that appeal to value-oriented buyers.

i) Damac Hills 2

Damac Hills 2 recorded high Q4 villa/townhouse transactions and continues to be one of the key villa communities in Zone 6. Both its scale and pricing segmentation have made it a focal point for off-plan villa demand.

j) Damac Lagoons

Damac Lagoons completed the list of top five villa/townhouse locations by transaction volume, evidencing the strength of master-planned villa communities targeted at both investors and end-users. Transactions here are more weighted toward off-plan stock, in line with broader villa segment trends.

Collectively, Damac Island City, The Valley, DIP 2, Damac Hills 2, and Damac Lagoons accounted for 46% of all villa/townhouse transactions in 2025, underscoring the concentration of activity in a handful of large-scale communities.

7. Buyer & Investor Behavior in Dubai Residential Market

The Dubai residential market Q4 2025 was characterised by persistent off-plan preference, diverse buyer nationality, and deepening demand in the prime segment. Off-plan transactions rose to 72% of total activity, illustrating that many buyers are willing to commit earlier in the development cycle in exchange for structured payment plans and product choice.

High-net-worth individuals played a growing role in shaping demand for prime residential assets. During 2025, more than 6,700 units priced above AED 10 million were transacted, up from 4,600 in 2024, representing a 43% year-on-year increase in ultra-prime activity.

Within this prime band, villa transactions grew by about 40% year-on-year, while apartment transactions in the same price bracket rose by about49%, showing that luxury demand is broadening beyond traditional villa-only preferences. Around 71% of all transactions above AED 10 million occurred in the off-plan segment, consistent with the citywide tilt toward under-construction schemes.

Map Homes Real Estate engaged with buyers from 33 different nationalities in transactions over AED 10 million during 2025, demonstrating the global investor base underpinning Dubai residential real estate. Political stability and sustained economic growth are key drivers attracting talent and strengthening rental demand across the city.

8. Supply Pipeline & Outlook for Dubai Property Market

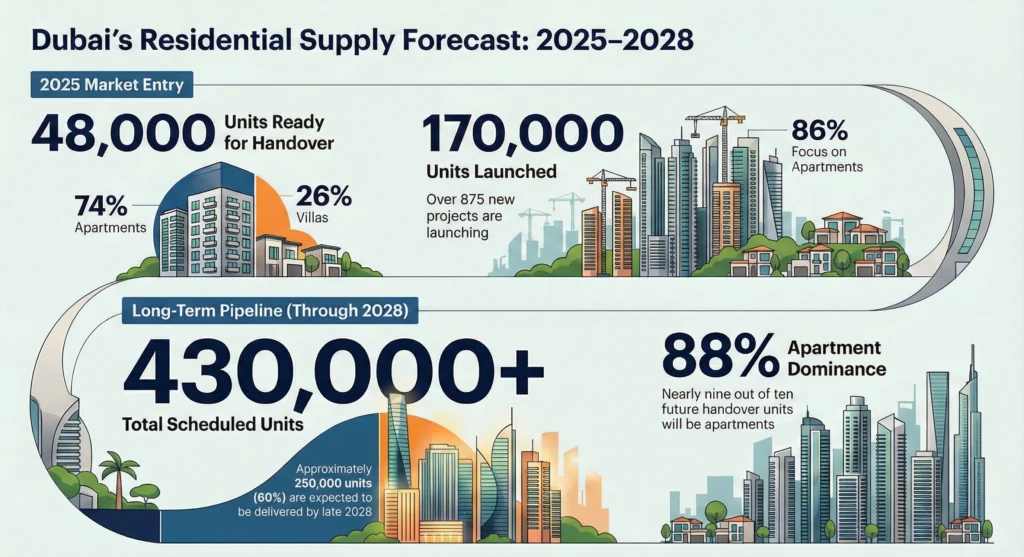

On the delivery side, Dubai saw about 48,000 residential units handed over in 2025, with 26% as villas/townhouses and 74% as apartments, broadly mirroring 2024’s handover mix. Key Q4 2025 completions included multiple Emaar projects in Arabian Ranches 3, Aura Gardens in Tilal Al Ghaf by MAF, and Jebel Ali Village Townhouses by Nakheel.

Handovers in Q4 slowed to roughly half the levels recorded in Q1–Q3 2025, contributing to a more balanced supply-demand environment as transaction volumes remained robust. Nevertheless, the forward supply pipeline is substantial and will be a major factor for the Dubai housing market Q4 2025 and beyond.

Developers launched more than 170 projects in Q4 2025 alone, comprising over 41,000 units. For the full year 2025, project launches surpassed 875 schemes with approximately 170,000 associated units, of which 86% are apartments; these figures are slightly below the roughly 190,000 units launched in 2024 but still historically elevated.

Looking ahead, more than 430,000 units are scheduled for completion over the next three years, and Map Homes assumes that around 60% of this pipeline will actually be delivered within that timeframe. This implies that about 250,000 units could join the ready stock by the end of 2028, with 88% of this future handover supply being apartments, broadly aligned with the current transaction split.

9. Expert Commentary on Dubai Real Estate Market 2025

The experts position 2025 as a year of exceptional performance for Dubai’s residential market, underpinned by population growth, strong investor confidence, and the city’s increasing appeal to high-net-worth individuals. Analysts also note that the ready market’s steady transaction volume despite higher supply points to lengthening ownership periods, which can be interpreted as a sign of maturing end-user commitment.

At the same time, the experts emphasise mounting affordability pressures in the owner-occupier segment due to the combination of the 80% LTV ceiling for properties under AED 5 million and elevated interest rates. This environment favours buyers with stronger equity positions and may channel more demand toward off-plan structures that offer phased payments.

The commentators have highlighted that absorption rates have declined in aggregate, but high-quality projects from reputable developers are still selling within weeks of launch. This divergence suggests that product, location, and developer reputation are increasingly critical differentiators, reinforcing the need for careful asset selection in Dubai residential real estate.

On the rental side, rental growth for existing leases remains capped under RERA, but new lease rents continued to rise in 2025 as population growth drove demand. Apartment rents grew by 7.7% over the year, while villa rents increased by 8.6% year-on-year, with villa rents showing signs of leveling off after strong growth in the first eight months.

10. Conclusion: Outlook for Dubai Residential Market Q4 2025

Q4 2025 confirmed that the Dubai Residential Market Q4 2025 is operating at historically high levels of activity, with record transaction volumes, robust off-plan demand, and rising capital values across both apartments and villas. The quarter also reinforced the structural importance of key corridors such as Zone 6 and large master-planned communities that collectively account for a dominant share of residential transactions.

For investors, the data points to a market where off-plan projects, prime assets, and well-located communities continue to attract deep, diversified demand, including from a wide international buyer base. However, the sizable upcoming supply pipeline—particularly in apartments—introduces the potential for a gradual shift from undersupply to potential oversupply, especially in more affordable districts.

Expert commentary suggests that most forward-looking scenarios imply slower growth or moderate price declines rather than abrupt corrections, making selectivity and realistic yield expectations critical. Q4 2025 therefore stands as a pivotal quarter that combines cyclical strength with emerging supply-side risks, offering both opportunities and the need for disciplined strategy in the Dubai property market 2025.

Frequently Asked Questions

Sales transactions hit record highs with off-plan properties dominating 70%+ of activity, while ready homes saw steady demand.

Average prices increased 15-20% year-on-year, led by villas in areas like Dubai Hills and JVC.

Population influx, investor confidence, and 48,000+ unit deliveries fueled transactions worth AED 140bn+.

JVC, Business Bay, Dubai Marina, and Arjan topped sales volumes and yields (7-8%).

+17% transactions, +16% prices vs. 2024; off-plan sales up 24%.

Key trends in the Dubai residential market include growth in luxury villas, high demand for apartments, and increasing foreign investment.

The Dubai residential market is expected to grow steadily in 2026, with sustained interest in luxury and off-plan properties.