Dubai Land Residence Complex (DLRC) – Dubai’s New Budget Housing & Investment Destination

Dubai Land Residence Complex: Dubai’s Budget Living Hub

The Dubai Land Residence Complex (DLRC) is emerging as Dubai’s solution for affordable housing. While luxury towers and high-end penthouses dominate the city, middle-income residents often struggle with soaring rents and property prices. Located in Dubailand, DLRC offers ready-to-move-in apartments, smart infrastructure, and budget-friendly prices, making it an appealing choice for families and professionals alike.

This blog explores whether DLRC is truly Dubai’s next budget housing hub, covering pricing, lifestyle, and future growth potential.

Dubai Land Residence Complex (DLRC): Overview & Location

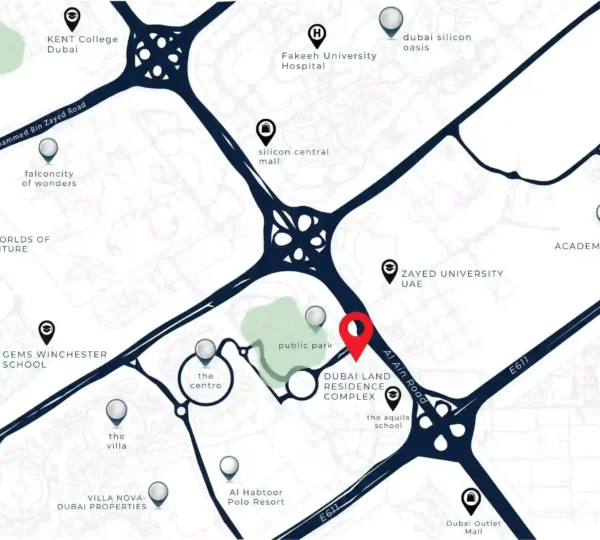

The Dubai Land Residence Complex (DLRC) is an emerging community in Dubailand, designed for affordable living without compromising connectivity. Positioned between Academic City and Global Village, DLRC offers easy access to Sheikh Mohammed Bin Zayed Road (E311), linking residents to Downtown Dubai, Business Bay, and Dubai Silicon Oasis.

Looking ahead, DLRC is set to benefit from future metro extensions, enhancing public transport options and making it an even more attractive choice for mid-income families and professionals.

Living here means you’re:

10 mins from Academic City’s universities

12 mins from Global Village

20–25 mins from Downtown Dubai

25–30 mins from both DXB and DWC airports

In short, DLRC nails the classic real estate mantra — “location, location, location” — but with an affordable twist.

A Quick History of Dubai Land Residence Complex (DLRC)

The Dubai Land Residence Complex (DLRC) traces its roots to the early 2000s as part of Dubailand’s master plan. Originally intended to support nearby entertainment and academic zones, DLRC remained under the radar while other neighborhoods flourished.

Over time, developers like Wasl Properties and Dubai Properties recognized its potential, building low- to mid-rise apartments focused on functionality and affordability — laying the foundation for today’s emerging budget-friendly community in DLRC.

Here’s a snapshot timeline:

2006–2010: Area mapped and infrastructure laid

2012–2016: First wave of residential developments

2018–2021: Rise in occupancy and expat demand

2022–Present: Surge in interest due to Dubai’s housing crunch and new investor incentives

Of course, it hasn’t always been smooth sailing. For years, DLRC flew under the radar due to low marketing, minimal branding, and limited investor attention. But as Dubai’s real estate gears toward inclusivity, DLRC’s underdog status is finally starting to pay off.

Why is DLRC Suddenly Gaining Traction in 2026?

In 2026, Dubai’s soaring real estate prices are pushing buyers and renters toward emerging communities, and the Dubai Land Residence Complex (DLRC) is benefiting. With apartment prices up over 32% between 2022 and 2024 in prime areas like Downtown and Dubai Marina, DLRC offers affordable entry points and growing infrastructure, making it an attractive option for both end-users and investors.

Here’s why 2025 is DLRC’s breakthrough year:

Property prices still 20–30% lower than JVC or Arjan

Developer activity has doubled since late 2023, with several new off-plan projects launching in early 2025

UAE government initiatives, such as zoning incentives and utility subsidies, are now focused on boosting affordable housing stock

The demand wave is being driven by:

Mid-income families priced out of traditional suburbs

Blue-collar professionals working near Academic City, DIC, and Al Barsha South

Young couples and first-time buyers seeking budget-friendly ownership options without compromising on lifestyle

Comparative Price Trends (2018–2025): DLRC vs Key Emerging Areas

Community | 2018 | 2021 | 2023 | Q1 2025 | Total Growth (2018–2025) | Current Avg. Price/Sq.Ft | Affordability Rank |

DLRC | AED 600 | AED 750 | AED 900 | AED 1,050 | +75% | Lowest | Most Affordable |

JVC | AED 700 | AED 900 | AED 1,112 | AED 1,443 | +106% | 20–30% higher than DLRC | Moderate |

Arjan | AED 550 | AED 650 | AED 1,000 | AED 1,182 | +115% | 10–15% higher than DLRC | Moderate |

Key Takeaways:

DLRC offers the best price-to-location value among emerging communities.

Despite steady growth (+75% since 2018), DLRC remains the most affordable per sq. ft in Q1 2025.

DLRC’s price gap of 20–30% below JVC and Arjan makes it attractive for first-time buyers and mid-income families.

Infrastructure growth + future metro access = high appreciation potential with low entry cost.

DLRC’s price trajectory shows healthy appreciation without speculative overheating, making it an ideal sweet spot for budget-conscious buyers seeking long-term value in a well-connected, rapidly developing zone.

What Kind of Properties are Available in DLRC?

The Dubai Land Residence Complex (DLRC) offers a variety of residential options tailored for working professionals, young families, and long-term expats:

Here’s what’s on the menu:

Affordable Apartments: Mid-rise buildings with clean layouts and essential amenities such as gyms, covered parking, and 24/7 security.

A growing number of mid-size townhouses are being introduced, primarily in gated clusters within the community.

Staff & Labor Housing: Dedicated zones for staff accommodation, supporting businesses in nearby Academic City and Dubai Silicon Oasis.

Unit Configurations & Average Sizes:

Studios: ~400–500 sq. ft

1-Bedrooms: ~650–800 sq. ft

2-Bedrooms: ~950–1,200 sq. ft

Current Market Prices (Q1 2025):

Average price in DLRC: AED 650 per sq. ft

Significantly lower compared to JVC (AED 950 psf) and other nearby hubs

Property Price Comparison Table (2026)

Area | Avg. Price per Sq. Ft | Studio Avg. Price | 1BR Avg. Price | 2BR Avg. Price |

DLRC | AED 650 | AED 380,000 | AED 550,000 | AED 750,000 |

JVC | AED 950 | AED 530,000 | AED 750,000 | AED 1,000,000 |

Arjan | AED 880 | AED 500,000 | AED 720,000 | AED 950,000 |

Dubai South | AED 720 | AED 450,000 | AED 680,000 | AED 880,000 |

The Dubai Land Residence Complex (DLRC) offers affordable homes, strong rental yields, and functional layouts, making it a top choice for tenants, families, and investors in Dubai. Its practical, budget-friendly approach sets DLRC apart in the city’s mid-income housing market.

Why Dubai Land Residence Complex (DLRC) Appeals to Tenants & Residents

DLRC is quietly becoming the everyday resident’s choice — offering balance, affordability, and livability without the downtown price tag.

Here’s who’s calling DLRC home:

Mid-income families working in Academic City, Silicon Oasis, or DIP

Young couples seeking starter homes without massive EMIs

Expats from the Philippines, India, Pakistan, and parts of Africa, drawn by affordable rents and accessible transit

Rental prices in DLRC range from just AED 30,000 to AED 55,000/year, depending on unit size and condition — far more accessible than nearby communities like JVC or Discovery Gardens.

Lifestyle Amenities Nearby:

Schools: GEMS FirstPoint, Indian International School, The Aquila School

Mosques: Multiple community mosques within walking distance

Healthcare: Right Health Clinics, Fakeeh University Hospital (10–15 mins drive)

Parks & green zones: Pocket parks and walkable areas are increasingly being integrated

While DLRC isn’t yet a walker’s paradise, it’s catching up fast. On walkability and lifestyle scores, it currently ranks just below JVC, but above Dubai South due to better density and surrounding infrastructure.

Rental Yields in 2025: DLRC vs. Affordable Communities

Community | Avg. Annual Rent (1BR) | Avg. Property Price (1BR) | Rental Yield |

DLRC | AED 40,000 | AED 550,000 | 7.2% |

JVC | AED 55,000 | AED 750,000 | 7.0% |

Arjan | AED 52,000 | AED 720,000 | 6.6% |

Dubai South | AED 45,000 | AED 680,000 | 6.6% |

Discovery Gardens | AED 50,000 | AED 800,000 | 6.2% |

Bottom line: DLRC isn’t just affordable — it’s profitable. With above-average yields and a growing tenant base, the area is ticking all the right boxes for investors and long-term renters alike.

Investor Perspective: ROI, Capital Appreciation & Risks

The Dubai Land Residence Complex (DLRC) is emerging as an investor-friendly community in Dubai. Apartments in DLRC offer rental yields of 7.5–9%, while capital appreciation has averaged 6–8% annually since 2022. With growing demand and ongoing infrastructure projects, DLRC presents both strong short-term rental returns and long-term investment potential.

Pros:

Low entry price point: Studios and 1BR units start around AED 380K–550K, much lower than neighboring JVC or Arjan.

Strong rental demand: Proximity to Academic City and Dubai Silicon Oasis ensures steady tenant inflow.

Emerging infrastructure promises better connectivity soon, which can further boost property values.

Risks:

Limited brand recognition compared to more popular Dubai communities could affect resale liquidity.

Some parts of DLRC still have incomplete infrastructure, meaning residents and investors must be patient for full development.

ROI Breakdown for AED 500K Studio Investment in DLRC

Component | AED Value | Notes |

Initial Investment | 500,000 | Purchase price of a studio unit |

Annual Rental Income | 40,000 | Based on 8% gross yield |

Annual Expenses | 8,000 | Maintenance, service charges, management fees (approx. 1.5%) |

Net Annual Income | 32,000 | Gross income minus expenses |

Appreciation (Yearly) | 35,000 | Estimated 7% capital growth |

Total Annual ROI | 67,000 | Rental income + appreciation (~13.4%) |

DLRC’s numbers tell a compelling story for budget-conscious investors looking for steady returns and future upside — but with the usual caveat: patience and awareness of ongoing development stages.

Upcoming Projects & Infrastructure at Dubai Land Residence Complex (DLRC)

DLRC is no longer just a quiet neighborhood—it’s gearing up for a transformational phase fueled by several exciting developments and infrastructure upgrades. The word on the street? Big things are coming!

Here are some of the key projects currently underway or planned:

The Meadows Edge by Dubai Properties — a mid-rise apartment community offering modern layouts with attractive payment plans, set to redefine affordable urban living.

Palm Bay Residences — a waterfront-inspired project focusing on smart design and lifestyle amenities tailored for families and professionals.

Al Jaddaf Villas Expansion — adding new townhouse options to accommodate growing demand for spacious homes within DLRC.

The Dubai Land Residence Complex (DLRC) is set for major connectivity and community upgrades. A proposed Dubai Metro Red Line extension will bring a station near DLRC, cutting commute times to Downtown and Dubai Marina. Road improvements on Sheikh Mohammed Bin Zayed Road (E311) and surrounding arteries will further ease traffic.

Community enhancements, including new parks, jogging tracks, and retail zones, aim to create a walkable, vibrant neighborhood. Aligned with Dubai’s vision for sustainable growth, DLRC is poised to become a self-sufficient, affordable, and accessible district in the coming years.

DLRC vs. Other Affordable Housing Areas

The Dubai Land Residence Complex (DLRC) stands out for its mix of affordability, connectivity, and ongoing infrastructure upgrades. Located near Academic City and Sheikh Mohammed Bin Zayed Road, DLRC offers apartments around AED 650 per sq. ft with rental yields of 7.5–9%, making it ideal for budget-conscious investors and first-time buyers.

Dubai South appeals with its master-planned layout and Expo 2020 legacy, offering larger villas and greener spaces, but its connectivity is less immediate, with rental yields of 6.5–7%.

International City Phase 2 provides ultra-affordable rents and a multicultural community but lags in infrastructure and long-term growth, suiting mainly blue-collar tenants.

Town Square attracts young families with parks and retail amenities but is pricier (~AED 800+ psf) and offers moderate rental yields (~6%), making DLRC the more balanced option for affordability and investment.

Let’s compare DLRC with popular affordable zones:

Feature | DLRC | Dubai South | Intl City Phase 2 | Town Square |

Avg Price/Sq Ft | AED 650 | AED 700 | AED 550 | AED 850 |

Studio Price | AED 465K–650K | AED 500K–700K | AED 400K–550K | AED 650K–850K |

Rental Yield | 6–9% | ~7% | ~7–8% | 5–6% |

Metro Access | Planned | Upcoming (South Dewa) | On‑site (Green Line) | None |

Amenities | Good, developing | Moderate | Basic | Advanced |

Family Appeal | Strong (schools, parks) | Moderate | Moderate | High |

Investment Potential | High | Medium–High | Medium | Medium |

✔️ Who’s It For?

End-users (families): DLRC wins on affordability, schools, and community. Town Square has more green spaces, but DLRC is cheaper per sq ft.

Investors seeking yield: DLRC’s 8.5% yields (studios) outperform Town Square (~5–6%) and rival Dubai South (~7%) .

Capital appreciation: DLRC’s 9–10% p.a. growth matches Dubai South expectations, though Town Square might improve if further supply slows.

In summary, DLRC offers a rare combo: top-tier yields, affordable pricing, and a promising absorption of new infrastructure.

Schools, Malls & Facilities Near Dubai Land Residence Complex (DLRC)

The Dubai Land Residence Complex (DLRC) offers convenient access to essential amenities for families and residents. Quality schools like The Aquila School, GEMS FirstPoint, and Indian International School are just a short drive away, serving the community’s multicultural population.

Shopping and leisure are also nearby, with Dubai Outlet Mall less than 15 minutes away and Global Village offering seasonal events, dining, and shopping. Healthcare is within easy reach too, with Right Health Clinic and Fakeeh University Hospital providing quick access to medical care.

When it comes to connectivity, DLRC residents enjoy reasonable travel times to major Dubai landmarks:

Downtown Dubai: ~25 minutes

Business Bay: ~22 minutes

Dubai International Airport (DXB): ~30 minutes

All told, DLRC’s location offers a balanced lifestyle, blending affordability with accessibility to schools, shopping, health, and key business districts.

Challenges Facing Dubai Land Residence Complex (DLRC)

While the Dubai Land Residence Complex (DLRC) is emerging as a budget-friendly housing option, it faces a few challenges. Public transport remains limited, with no active metro stations and few bus routes, restricting mobility for non-drivers. High-end retail and entertainment are sparse, requiring residents to travel for premium shopping or dining.

Walkability is still developing, and brand awareness is low, meaning some buyers and renters are unaware of DLRC’s potential. However, ongoing infrastructure projects and community initiatives aim to address these issues, improving accessibility, amenities, and market visibility over time.

Expert Insights on Dubai Land Residence Complex (DLRC)

The Dubai Land Residence Complex (DLRC) is gaining attention as a promising affordable housing community, attracting mid-income buyers seeking value, connectivity, and amenities. Bayut’s 2024 Dubai Market Report cites DLRC’s steady price appreciation and growing rental yields as key drivers for investor interest.

Property Finder analysts highlight DLRC’s strategic location near Academic City and planned metro expansions, supporting sustainable growth over the next five years. Developers envision a self-contained district with schools, healthcare, green spaces, and retail hubs, making DLRC a future go-to choice for affordable urban living in Dubai.

Source: Bayut Dubai Market Report, Property Finder Insights

Is Dubai Land Residence Complex (DLRC) Worth It in 2026 and Beyond?

Pros:

Affordable entry: studios ~AED 465K, 2 BR ~AED 750K

Strong rental yields: 6–9% gross

Solid capital growth: ~8–10% p.a.

Comprehensive schools, clinics, retail, parks

Cons:

No Metro yet, slight traffic snags

Brand still in development; retail v. light

Quality varies by developer; resale unpredictable

Who It Suits Best:

Investors wanting high yields and healthy capital growth

Families/mid-income earners prioritizing value and access over luxury

First-time buyers ready for off‑plan flexibility

Final Take: DLRC is an outstanding emerging suburb offering real value, quality living, and future upside—ideal for those who want Dubai living without premium pricing.

Ready to Invest in Dubai Land Residence Complex (DLRC)?

If the Dubai Land Residence Complex (DLRC) fits your budget-friendly housing needs, explore our latest listings of apartments and townhouses designed for modern living. Stay ahead with our guide to upcoming DLRC developments, uncovering the best investment opportunities.

At Map Homes Real Estate, we provide expert advice and personalized support to help you navigate Dubai’s affordable housing market and make the most of DLRC’s potential.

Frequently Asked Questions

DLRC is a mixed-use freehold community in Dubailand spanning 14M sq ft, blending affordable apartments, villas, retail, and amenities along Dubai-Al Ain Road (E66) and Emirates Road (E611).

Strategically in Dubailand, 15-20 mins from Downtown Dubai, DXB Airport, Academic City, Silicon Oasis; near The Villa community with easy E66/E611 highway access.

Yes, 5-8% ROI potential from high rental demand (families/professionals), metro Blue Line proximity (2029), infrastructure growth boosting capital appreciation.

Key off-plans: Samana Parkville (Q4 2027, pool), AG Square (Q1 2025), Arib Boutique (Q4 2026), Reef 1000, Cove Edition—deliveries thru 2028.

5-10 mins from upcoming Dubai Metro Blue Line (2029); current bus/taxi via E611. Future extension will connect Academic City-Downtown seamlessly.

Yes, low-rise plots alongside high-rise apartments; private gardens, parking, community parks—affordable vs central Dubai.

Yes. DLRC includes freehold zones where expatriates and foreign investors can buy residential units, making it accessible for both local residents and international buyers.