Why Invest in Dubai Real Estate in 2026? 10 Reasons That Will Change Your Mind

Why Invest in Dubai Real Estate? An Introduction for Smart Investors

Why invest in Dubai real estate? Because it’s one of the few markets where your money works on three fronts simultaneously — tax-free rental income, strong capital appreciation, and a pathway to long-term residency. In 2026, that triple advantage is more compelling than ever.

The Story That Started With AED 2 Million

Priya Mehta, a Mumbai-based finance professional, was tired of watching inflation erode her savings. In early 2023, she asked herself why invest in Dubai real estate over traditional investment vehicles — and decided to find out firsthand by putting AED 2 million into a two-bedroom apartment in Business Bay. The results were far from accidental.

- Her property appreciated by over 16% within 12 months

- Annual rental income hit AED 144,000 — entirely tax-free

- Blended ROI combining rental yield and capital gains approached 12%

- She qualified for the UAE Golden Visa, securing 10-year renewable residency for her family

Priya’s story isn’t a one-off. It’s a blueprint thousands of global investors are quietly replicating right now — and it perfectly answers why invest in Dubai real estate when wealth preservation and growth are both on the table.

Why Invest in Dubai Real Estate — The Direct Answer

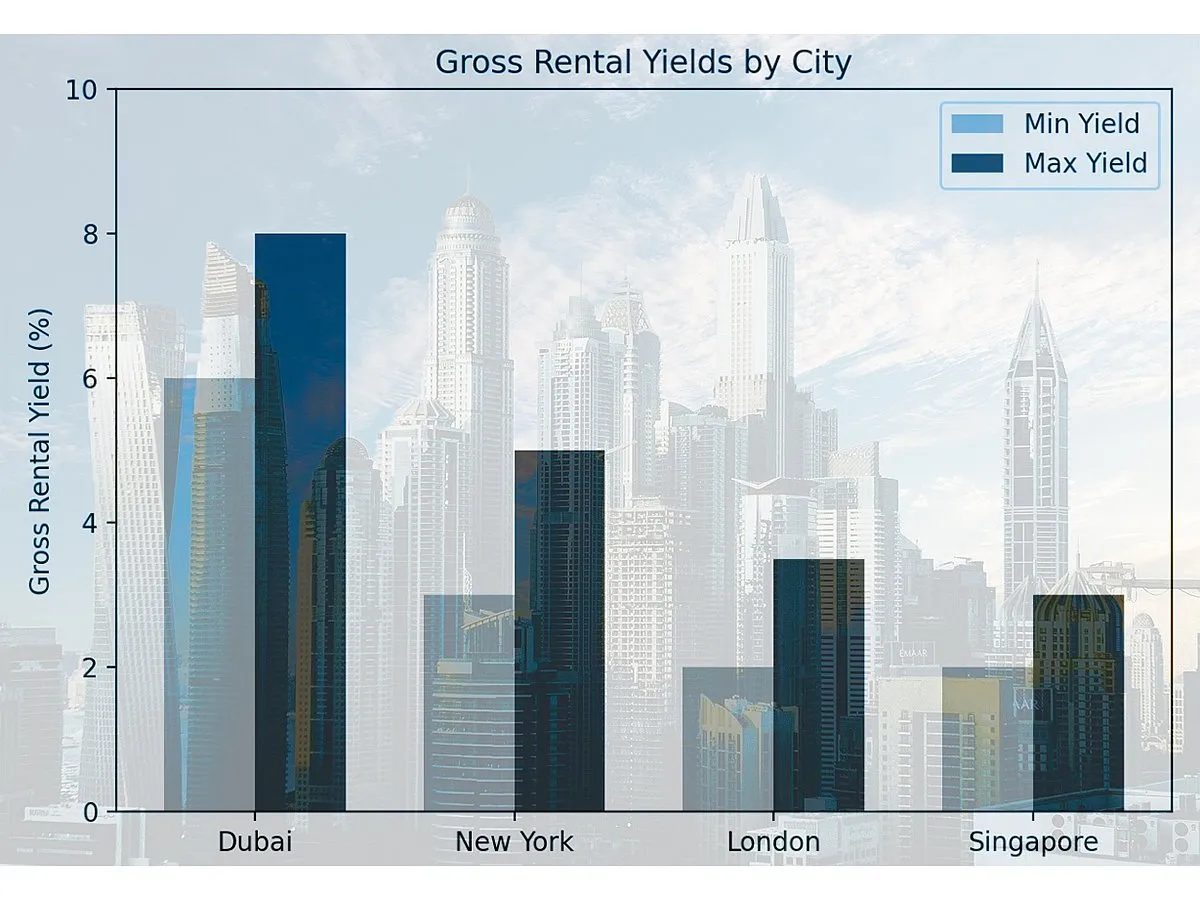

Why invest in Dubai real estate? Because Dubai delivers 6.7–6.9% gross rental yields — crushing London (2–4%), New York (3–5%), and Singapore (2.5–3.5%). Zero income tax, zero capital gains tax, and a Golden Visa from just AED 2 million make it a convergence no Western market can match.

The five pillars driving Dubai property investment in 2026:

- Tax-free — Keep 100% of rental income and capital gains

- High yields — 6.7–8%+, hitting 9%+ in International City

- Capital growth — 16.5% YoY, vs New York (8.1%) and London (1.6%)

- Golden Visa — AED 2M+ buys 10-year renewable residency with family sponsorship

- Infrastructure — Built for investor confidence

The numbers back it up: Dubai Land Department recorded 205,100 transactions in 2025 — up 18.33% YoY — totaling AED 539.9 billion, a 24.67% rise versus 2024. For investors still wondering why invest in Dubai real estate, the transaction volume alone tells the story (Global Property Guide).

The window is open. 2026 is the time to act.

Reason 1: No Taxes, Pure Profits – A Key Reason to Why Invest in Dubai Real Estate

Dubai levies zero personal income tax, zero capital gains tax, and zero annual property tax. Every dirham you earn stays yours — which is precisely why invest in Dubai real estate over markets where the taxman claims 30–45% of your gains.

With rental yields averaging 7–8% and capital appreciation running at ~15% YoY, your net ROI can realistically hit 10–15% — figures virtually impossible to replicate in heavily taxed Western markets.

Tax Type | Dubai | UK | USA |

Income Tax on Rent | 0% | Up to 45% | Up to 37% |

Capital Gains Tax | 0% | 18–28% | 15–20% |

Annual Property Tax | None | Council Tax + Stamp Duty | ~0.88% of assessed value |

Inheritance Tax | 0% | Up to 40% | Up to 40% |

One-Time Transfer Fee | 4% DLD | Up to 15% Stamp Duty | Varies by state |

Sources: PwC UAE Tax Summary

Reason 2: Sky-High Rental Yields That Global Markets Can’t Touch

Dubai’s average gross rental yield sits at 6.7–6.9% — with apartments outperforming at 7.1–7.3% — in a world where 2–4% is considered normal. For income-focused investors asking why invest in Dubai real estate, those yield spreads alone justify the flight ticket.

What’s fuelling this? Dubai’s population growth is a massive driver. With 90,000 new units completed in 2025 and 120,000 more in 2026, tenant demand from an ever-expanding expat workforce keeps occupancy rates strong. More residents, more renters — simple supply and demand.

Stack Dubai against global markets and the gap becomes stark:

City | Avg. Gross Rental Yield | Income Tax on Rent |

Dubai | 6.7–9%+ | 0% |

Singapore | 2.5–3.5% | Up to 22% |

Hong Kong | 2.0–3.0% | Up to 15% |

London | 2.5–4.0% | Up to 45% |

New York | 3.0–5.0% | Up to 37% |

Sources: Red Horizon DXB

Reason 3: Explosive Capital Growth That Compounds Year After Year

Why invest in Dubai real estate when other asset classes offer returns? Because Dubai properties don’t just generate income — they grow aggressively in value. Price-per-square-foot surged from AED 1,039 in 2022 to AED 1,386 in 2024 — a 33% appreciation in just two years.

The off-plan segment tells an even bigger story. Emaar recorded AED 51 billion in sales in just the first 8 months of 2025, while DAMAC followed with AED 24 billion — a clear signal that institutional money is doubling down.

Dubai Capital Appreciation by Area (2022–2026)

Area | 2022 Avg. Price/sqft | 2024 Avg. Price/sqft | Growth | 2026 Outlook |

JVC | AED 896 | AED 1,016 | +13.4% | Strong ↑ |

Dubai Marina | AED 1,501 | AED 1,737 | +15.7% | Stable ↑ |

International City | AED 504 | AED 583 | +15.5% | High ↑ |

DAMAC Hills 2 | AED 626 | AED 743 | +18.7% | Moderate ↑ |

Business Bay | AED 1,400 | AED 1,650 | +17.8% | Stable ↑ |

Downtown Dubai | AED 2,100 | AED 2,400 | +14.3% | Moderate ↑ |

Sources: ValuStrat

Reason 4: How World-Class Infrastructure Explains Why Invest in Dubai Real Estate

Dubai real estate investment rides on infrastructure that most cities can’t match. Dubai’s 2026 budget allocates a record AED 47.8 billion purely to infrastructure — and every dirham spent pushes property values higher, answering the question of why invest in Dubai real estate with billions in government-backed proof.

The biggest value drivers right now:

- Metro Blue Line — unlocking Silicon Oasis, Mirdif, Academic City

- Al Maktoum Airport expansion — making Dubai South the next investment hotspot

- Expo City Dubai — fully operational residential and innovation hub

- Etihad Rail — Dubai to Abu Dhabi in under 50 minutes

Key Hubs — Infrastructure & Investment Snapshot

Area | Key Driver | Growth Outlook |

Dubai South | Al Maktoum Airport | +15–25% by 2026 |

Palm Jumeirah | eVTOL Vertiports | +10–15% YoY |

DSO / Academic City | Metro Blue Line | +20–30% post-completion |

JVC / Al Furjan | Metro + Al Khail Rd | +15–20% mid-2026 |

Source: Dubai 2040 Urban Master Plan | RTA Dubai

Reason 5: A Booming Population That Keeps Demand Red-Hot

More people means more tenants, more buyers, more demand — it’s that simple.

Dubai’s population hit 4.03 million in 2025, growing at 4.47% YoY — roughly 470 new residents every single day, driven by Golden Visa policies, business-friendly regulations, and a tax-free lifestyle.

The demand math is hard to ignore. That daily influx translates to a need for 150 new homes every day — yet actual completions are running well below that figure. This persistent supply gap keeps demand firmly in the investor’s favour.

Population Growth vs. Housing Supply — The Gap at a Glance

Metric | Figure |

Dubai Population (2025) | 4.03 million |

Daily New Residents | ~470/day |

Homes Needed Daily | ~150/day |

Units Launched in 2025 | 152,402 |

Units Actually Completed | 31,437 (21%) |

Projected New Residents (2026) | 175,000–225,000 |

Population Target by 2040 | 7.8 million |

Sources: Dubai Statistics Center | The National | Springfield Properties

Reason 6: Full Foreign Ownership – A Key Factor in Why Invest in Dubai Real Estate

Since 2002, foreign nationals have enjoyed full freehold ownership rights in designated zones — buy, sell, lease, mortgage, or pass to heirs, with no UAE national partner or sponsor required.

In 2025, freehold zones expanded further — Sheikh Zayed Road and Al Jaddaf were added, opening prime city-core locations to foreign buyers for the first time.

The ownership landscape now covers 40+ communities across every budget tier:

Freehold Zones — Ownership Types at a Glance

Zone Type | Popular Areas | Best For |

Urban Core | Downtown, Business Bay, DIFC | Professionals, high-yield |

Waterfront | Palm Jumeirah, Dubai Marina, JBR | Luxury, holiday lets |

Family Suburban | Dubai Hills, Arabian Ranches, Al Furjan | Long-term residents |

High-Yield Budget | JVC, International City, DSO | ROI-focused investors |

Emerging | Dubai South, Expo City | Capital growth plays |

Source: Dubai Land Department | Bayut Freehold Guide

Reason 7: Payment Plans That Put Property Within Reach

Dubai’s off-plan market has rewritten the rules. Enter with as little as 5–10% down, with the remainder spread across construction milestones. The most innovative option — a 1% monthly payment plan — means just AED 10,000/month on a AED 1M property, with zero bank approval needed.

The logic is simple: lock in today’s price, watch it appreciate during construction, and often generate rental income before you’ve finished paying.

Developer Payment Plans — Dubai vs. The World

Feature | Dubai | UK | USA | Australia |

Min. Down Payment | 5–10% | 10–25% | 20%+ | 10–20% |

Interest on Plan | 0% | Bank rate | Bank rate | Bank rate |

Bank Approval Needed | ❌ No | ✅ Yes | ✅ Yes | ✅ Yes |

Post-Handover Plans | ✅ Yes | ❌ Rare | ❌ Rare | ❌ Rare |

Plan Duration | Up to 10 yrs | Mortgage only | Mortgage only | Mortgage only |

Sources: Better Homes Dubai

Reason 8: A Luxury Lifestyle That Explains Why Invest in Dubai Real Estate

People don’t just invest in Dubai real estate — they invest in a life upgrade. And that lifestyle pull keeps rental demand bulletproof.

The UAE ranked 2nd safest country globally in 2025, with 300+ days of sunshine, world-class healthcare, and top-tier international schools. Tenants here don’t just stay — they compete to live here.

Lifestyle Perks — What Keeps Dubai’s Rental Demand High

Lifestyle Perk | Dubai Offering | Investor Impact |

Beaches | JBR, Palm, Kite Beach — all public & free | High short-term rental appeal |

Shopping | 70+ malls including world’s largest Dubai Mall | Attracts premium-income tenants |

Safety | Top 2 globally, AI-powered surveillance | Families pay premium for secure communities |

Dining & Nightlife | 13,000+ restaurants, 200+ cuisines | Strong Airbnb & serviced apt demand |

Healthcare | JCI-accredited hospitals, DHCA-regulated | Long-stay expat tenant retention |

Education | 200+ international schools, IB & British curricula | Family tenants sign longer leases |

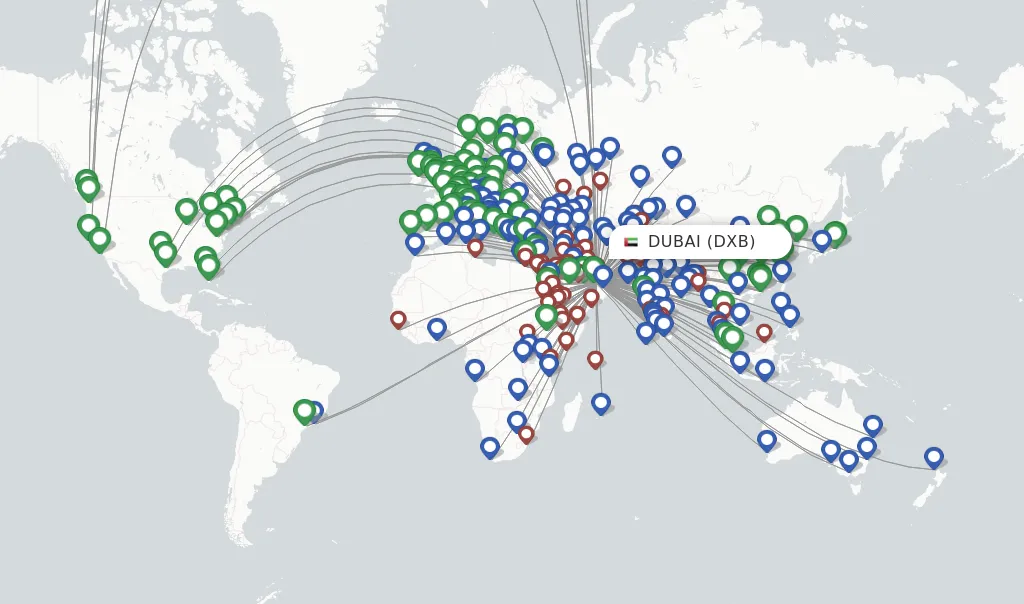

Connectivity | DXB connects to 260+ destinations | Digital nomads, frequent flyers |

Sources: Numbeo Safety Index 2025

As they say — location sells property, but lifestyle keeps tenants renewing leases. In Dubai, you get both.

Reason 9: A Diversified Economy That Shields Your Investment

Smart investors chase stability — and Dubai delivers it.

Over 95% of Dubai’s GDP is non-oil-based, with tourism alone contributing 20%. In H1 2025, Dubai’s economy grew 4.4% YoY to AED 241 billion — driven by trade, real estate, finance, and tourism.

That’s the economic bedrock behind Dubai’s resilience when global markets wobble:

Sector | GDP Contribution | Growth (2025) |

Wholesale & Retail Trade | 23.8% | +4.4% |

Tourism & Hospitality | ~13% | +7% visitor growth |

Real Estate | 7.8% | +7.8% YoY |

Finance & Banking | ~10% | +5.9% |

Oil | <1% | Negligible |

Sources: Dubai Data & Statistics | Gulf News | WTTC 2025 Report

Reason 10: A Prime Global Hub That Shows Why Invest in Dubai Real Estate

Geography is destiny — and Dubai’s is exceptional. Sitting at the crossroads of Europe, Asia, and Africa, Dubai sits within an 8-hour flight radius of two-thirds of the world’s population — a structural advantage that directly drives property values and rental demand.

Dubai operates the world’s busiest international airport for passenger traffic and hosts Jebel Ali Port — one of the world’s largest seaports — making it an unmatched multimodal trade gateway. The investment thesis practically writes itself.

Location Advantage — Connectivity & ROI Impact

Hub | Global Rank | Real Estate Impact |

Dubai Intl. Airport (DXB) | #1 busiest intl. airport | Drives expat demand, short-term rentals |

Al Maktoum Airport (DWC) | Future world’s largest (260M capacity) | Dubai South prices up +20–25% |

Jebel Ali Port | Largest port in Middle East | Industrial & logistics property demand |

Etihad Rail | Connects 11 UAE cities by 2026 | Commuter belt property appreciation |

Flight Radius | 8hrs = 2/3 of world’s population | Sustained multinational HQ demand |

Sources: ValuStrat | Sobha Realty | Deloitte Middle East

Ready to Claim Your Slice of Dubai?

The case is watertight. Zero taxes keeping your ROI intact. Rental yields that embarrass London and New York. A Golden Visa that turns a property purchase into a decade of freedom. Three reasons alone are enough — together, they’re almost unfair.

But here’s the real question: how long can you afford to sit on the sidelines while others build wealth in one of the world’s most investor-friendly markets?

Whether you’re eyeing your first off-plan apartment in JVC, a Golden Visa-qualifying unit in Business Bay, or a luxury villa on Palm Jumeirah — the right guidance makes all the difference.

Map Homes Real Estate specialises in matching global investors with the right Dubai property for their goals, budget, and timeline — from first inquiry to Golden Visa approval.

📞 Ready to start? Consult the Map Homes team today and make 2026 your year.

Frequently Asked Questions

Depending on location and property type, average gross rental yields range from 6% to 9%, with apartments in high-demand areas like JVC and Business Bay often exceeding that.

Absolutely — foreigners enjoy full freehold ownership in 40+ designated zones with no requirement for a local sponsor or UAE residency

A minimum property value of AED 2 million qualifies you for the 10-year Golden Visa, including off-plan and mortgaged units where your paid equity meets the threshold.

Dubai levies zero annual property tax, zero capital gains tax, and zero inheritance tax — making it one of the world’s most tax-efficient real estate markets.

Off-plan investments are protected under RERA’s strict escrow laws — all buyer payments are deposited into a dedicated account and released only as construction progresses.

Budget and mid-market communities like JVC, International City, and Al Furjan consistently deliver rental yields of 7–10%, outpacing most global metropolitan markets.

Yes — many international investors complete purchases entirely remotely through a RERA-registered broker and a notarised Power of Attorney.

Buying costs in Dubai average around $28,000 on a standard property — versus £18,700 in the UK (including up to 12% stamp duty and 28% CGT) and $31,500 in the USA — and that’s before accounting for Dubai’s zero ongoing property tax. Simply put, you pay less to enter, earn more in yield, and keep every dirham of profit.